A NATION FOUNDED ON COFFEE

Colombian coffees are much sought after for their excellent cup quality. This is an origin with one of the best developed coffee associations in the world; one that invests in rigorous research and extensive education for its coffee producers. Our export partners — La Palma & El Túcan in Cundinamarca and Fairfield Trading in Huila, Tolima and Nariño — exemplify this country's commitment to quality standards and its avant garde spirit.

Scroll down to:

Learn more about the coffee market in Colombia;

Meet our partners at origin;

Read our blog posts on Colombia;

Download hi-res photos;

See our Colombia offers list;

Download coffee information sheets;

See the FOB we paid for all coffees from Colombia in 2018.

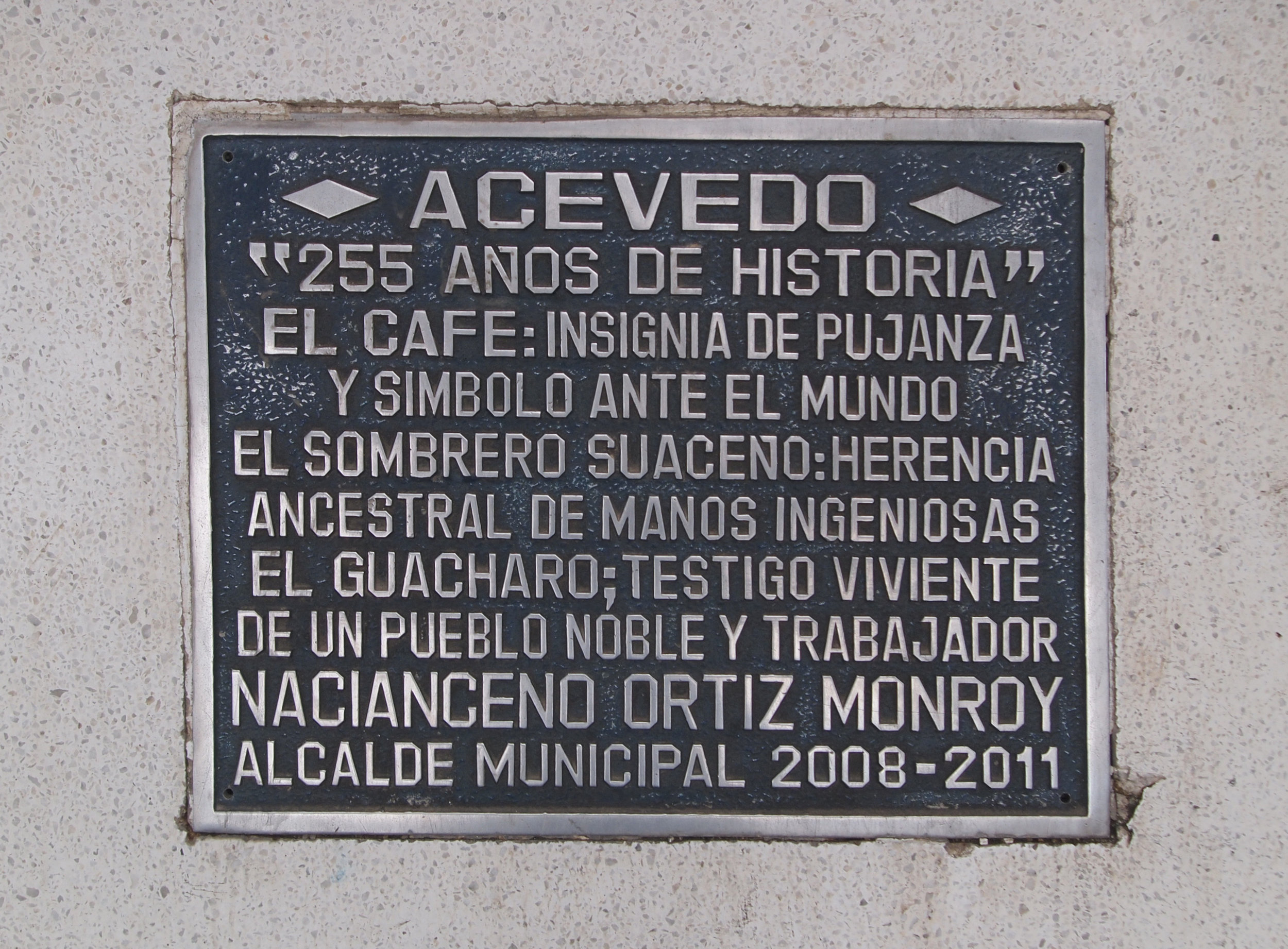

From left: Luis Anibal Calderon, Diego Erazo Martinez, Daniel Erazo Martinez, Maria Bercelia Martinez. Maria and her family are key CCS partners in the micro-region of Acevedo in Huila, Colombia.

HISTORY AND MARKET

It is believed that coffee arrived in Colombia in the 18th century by Jeusuit priests, though export did not occur until the 19th century. The biggest early market for Colombian coffee was the United States, followed by Germany and France.

Colombia is currently the third largest producer of coffee after Brazil and Vietnam but is the largest producer of Arabica coffee (100% of Colombian coffee is Arabica). While traditionally coffee production was dominated by large estates, the dramatic fall of international coffee prices that began in the early-1990s saw the rise of smallholder producers.

Central to Colombia’s sustained market dominance of high quality Arabica coffee has been the presence of the Federación Nacional de Cafeteros (FNC), Colombia’s coffee growers’ association, which was established in 1927. The FNC is the biggest agricultural non-profit organization in the world, and its management is democratically elected. Its mission is to ensure that Colombia’s coffee producers are empowered to make a good living through growing coffee in a sustainable manner, which it achieves through research and development, marketing, logistics and an extensive agricultural extension agent program.

We find great diversity amongst Colombian coffees – influenced primarily by the country’s diversity in soil, topography, microclimates, varieties, and increasingly, processing techniques.

Top of page

OUR PARTNERS AT ORIGIN

La Palma & El Túcan

La Palma & El Túcan (LP&ET) is a place as much as it is community and an approach to coffee making.

The place is a coffee farm located in the Cundinamarca department and it is a farm that defies conventional ideas about what a coffee farm is: it grows only exotic coffee varieties; accommodates coffee guests in beautiful cabins nestled amongst coffee plants that overlook majestic views; it is a wet mill that processes coffee using the latest knowledge and techniques for coffee fermentation.

The community is made up of around 90 neighboring smallholder farmers to LP&ET’s own farm and these neighbors work together with LP&ET’s team to ensure that their coffee plantations are both producing the best cherries possible, while ensuring the land is nurtured by organically composted fertilizer.

The approach is informed by a constant striving for quality and innovation. The LP&ET team is persistently looking out for better: from social/community, technological and environmental standpoints.

CCS has been LP&ET’s exclusive import partner in Europe since 2014.

Fairfield Trading

Since the 2015 harvest season, we have built some great relationships with farmers in the Huila and Tolima departments through Alejandro Renjifo, and his team at Fairfield. The fact that we have been working with several producers through successive seasons from these areas is a testament to the Fairfield team’s dedication. They are committed to upholding strict quality standards, and to educating their producers on agronomic and processing best practices.

The most exciting of the innovations that CCS and Fairfield have created together is the “CCS Acevedo Cup”: a quality competition that gathers the best lots from farmers living in and around the Acevedo Municipality during the main harvest season. This event serves several purposes: it celebrates the best lots and producers each season; strengthens community by gathering producing families together in a forum where they can exchange new knowledge and technology; and allows CCS’ roasters to identify potential long-term partners.

The Fairfield team, while small, is made up of individuals who truly place coffee at the center of their world. This lean team somehow manages to roast, cup and evaluate hundreds of lots per season, visit and consult with dozens of farmer partners throughout the year, and on top of that workload, several team members manage their own farms, or help their families manage their finca. Truly exceptional.

Colombia BLOG POSTS

Use the arrows on the right to browse all Colombia blog posts.

HIGH RESOLUTION PHOTOGRAPHS FOR DOWNLOAD

Right click on a photo below and select “Save Image As” to download.

FOB, CCS Colombia Selection, 2018

See the FOB we paid for all coffees purchased from Colombia in 2018.

The FOB represents the price we pay our export partners at origin. To calculate the cost we charge to roasters, we add the following:

Financing and logistics, on average USD $0.3/lb

(USD $0.4/lb for inland coffees such as Burundi).

We work with financing partners as we are an independent sourcing company without the capital to finance coffee. Logistics covers shipping, insurance and other costs to transport coffee from ports at origin to our warehouses located in Oslo, Hamburg, New Jersey and Oakland. This price is only for full containers. When we ship smaller quantities of coffee, like from Panama for example, financing and logistics costs are much higher.Our markup to cover our costs.

The markup varies, depending on the FOB, volumes purchased, and the need to remain competitive in the market. For example, we take a lower margin on our most expensive coffees. On average, in 2018, our markup is 20%.

So the equation for all origins, except Burundi, looks something like this:

Price to roasters per pound = (FOB + US$0.3) x 1.2

Price to roasters per kilo = (FOB + US$0.66) x 1.2

The equation for Burundi looks something like this:

Price to roasters per pound = (FOB + US$0.4) x 1.2

Price to roasters per kilo = (FOB + US$0.88) x 1.2

Please remember, these are averages.