Cupping a lot of coffee, that is a big part of what we do at origin, and that is how we began our Guatemala origin trip this year, early morning, late January, at the Bella Vista mill.

This trip grew in both emotion and size as the days passed. I began that day with David from Belleville Brûlerie in Paris, and by the end of it we collected Emily from Tandem Coffee in Portland, Maine, and Melanie Herrera from our export partners Zelcafe, for our trip to Huehuetenango.

HUEHUETENANGO

Thanks to a new domestic air route, it is possible to fly from Guatemala City to Huehue in half an hour, a great convenience compared to the 5 - 6 hour journey by road.

The difference between this region and Antigua is in the air, in the snippets of conversations I overheard which are not in Spanish but in the local Mayan language, Mam. The producers in this part of Guatemala are predominantly indigenous small holders, working on farms around one manzana in size (0.7 ha), processing in concrete tanks and wooden troughs on their property.

Byron Benavente is our guide to this region. A second generation coffee buyer, he has collaborated with our export partners, Zelcafe, for many years. He works with four farmer groups, divided geographically based on hillsides or towns: La Encenada, San Jacinto, Las Palomas and Todos Santos Cuchumatanes.

As always, the joy of these trips is connecting roasters to producers. Belleville have been buying San Jacinto for many years and Tandem Coffee feature Huehue coffees on their menu. It was emotional and educational to visit these producers with the people who roast their coffee.

This year, as per usual, expect Huehue coffees to be intense with notes of cacao.

ANTIGUA

Back in Antigua we were joined by Erik from KAFFA Oslo, plus Nicolas and Alex from Camera Obscura, Russia. Together we visited the farm of Dario Hernandez. CCS has been working with Dario for many years, and Kaffa has been buying his coffee since 2012. Lots that are not sold under his own name are sold through the Hunapu brand.

Next we visted the Potrero farm, managed by Luis Pedro Zelaya (LP) of Zelcafe. The team have invested heavily in renovating the farm and planting new varieties. LP is always experimenting and managing the farms to be more sustainable and productive, both in terms of quality and volume. For example, in one plot there is too much water in the soil, so they are experimenting with different varieties that will thrive in that environment.

AFTERMATH OF EL FUEGO

After several great days of cupping and farm visits, we said goodbye to our roaster friends from Russia, France and the US, and continued our journey with Luis Pedro to Candelaria in Acatenango. This area was in the direct path of lava, ash and molten rock that erupted from the El Fuego volcano in June of last year. It devastated local farms and homes, and as the suddenness of the eruption left little time for evacuation, and over 200 people died.

We have been sourcing coffee from a farm named after the region for many years, and went to see the impact of the natural disaster. Finca Candelaria has 280 hectares of coffee, 40 hectares of which were destroyed by the eruption. This entire area of the farm remains a dead zone, with no nutrition in the soil. LP and his team are experimenting with planting trees in coffee pulp to see if that provides enough food for the young plants to thrive.

REMA FUND DISTRIBUTION

Fortunately we had another, more joyous reason to visit Candelaria.

The Rema 1000 Fund is an initiative with our sister roastery, KAFFA Oslo and Rema 1000, a supermarket chain in Norway. As part of its mission to become one of Norway’s leading suppliers of organic and sustainable food products, Rema 1000 bought a farm-to-table restaurant chain in Norway called Kolonihagen. KAFFA now supplies Rema 1000 with specialty roasted coffee under the Kolonihagen brand, and CCS is sourcing the green coffee.

The clear advantage of supermarket distribution is that KAFFA can sell specialty coffee at a lower price than ever before. “Early in the planning stage we said that we would do that on one condition: we would pay more to the producers and their workers,” said Erik Rosendahl, CEO of KAFFA.

From the outset of the project, all four companies involved agreed to charge an additional 2 Norwegian Kroner (NOK) per bag (approx. $0.23 USD) to support the people employed on the farms where we source the coffee.

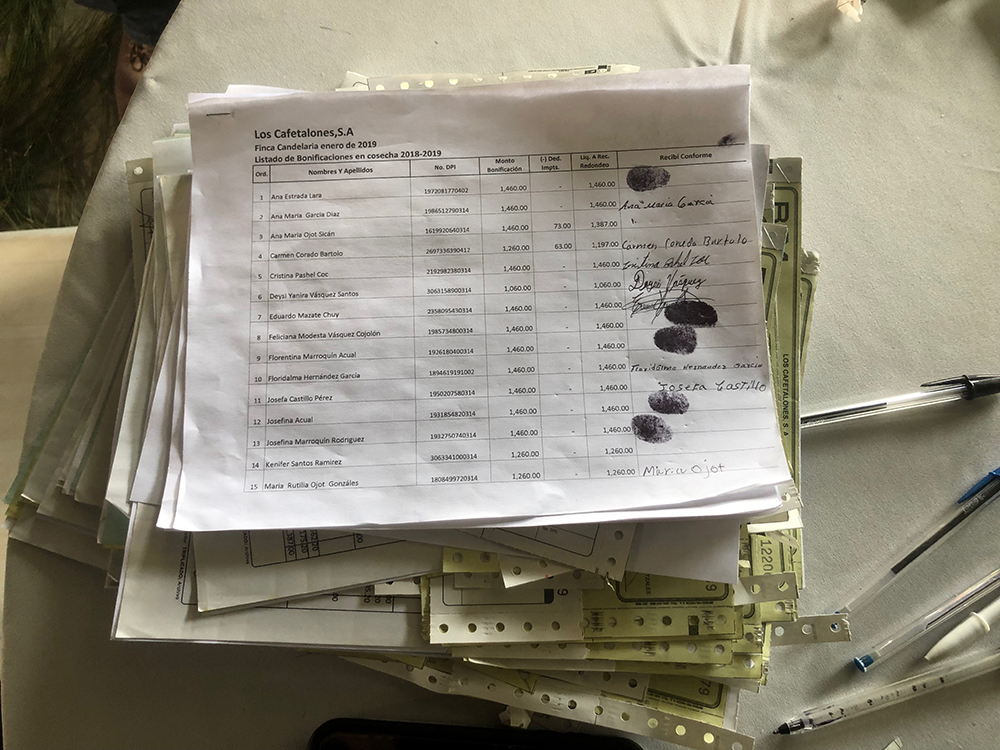

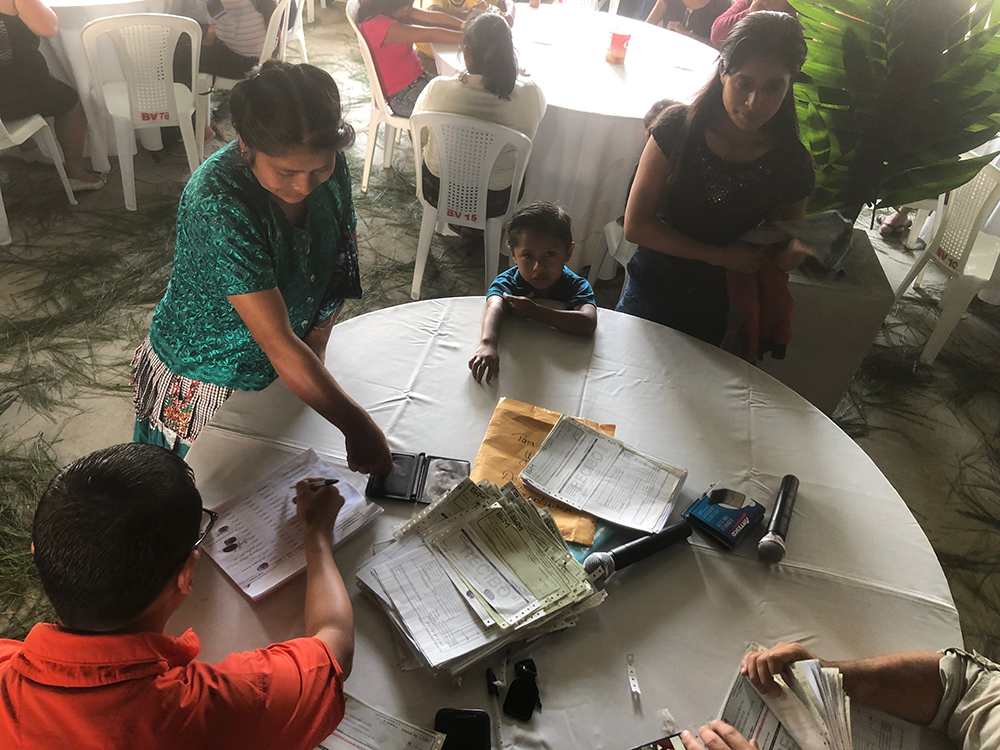

On this trip, Erik from Kaffa had the great pleasure of distributing funds to 135 workers, both seasonal and permanent, at the Candelaria mill. Each worker received between 1000 - 1500 Quetzales ($128 - $193 USD) which is at least half a monthly salary. In Guatemala we distributed $27,503 USD raised from the sale of 116,256 bags of 225g whole beans and ground coffee from Candelaria farm and mill.

Luis Pedro is a very caring and socially responsible person, and he organized a big fiesta to celebrate. He explained to the workers that the money comes from Norwegian coffee consumers, and it was touching to see the value this holds for workers in Guatemala, to feel their contribution recognized by coffee consumers so far away who were lucky enough to drink the literal fruits of their labor.

Erik said “it was a beautiful ceremony with the kids playing at the small kindergarten they have for the workers children on the farm. The Marimba band performed as the workers names were called to come and receive a check from the manager of the farm.”

To do this at Candelaria, a farm that was so recently hit by one of the biggest volcano eruptions in centuries, it was extra special. Not only did the farm lose 40 acres of coffee, many of the workers had personal losses.”

The extra payment came as many schools start and the families have extra costs for books and clothes.